Sideline money is in the trillions. Translation: commodities and gold will go on a tear.

Sideline Money In The Trillions

January 11 (King World News) – Art Cashin, Head of Floor Operations at UBS: Bulls continue to hold onto the edge, helped in no small part by a minor downtick in yields. If the yield on the ten-year moves back above 3.62% that could bring pressure back to stocks.

The general feel here is that sideline money, which is said to be quite large – in the trillions – is protectively deploying a little in front of speculation that tomorrow’s CPI number will be favorable. It is a bit of a gamble, but, I think, we are also seeing the repositioning of some money with probable tax selling having made for a slightly unseasonal weak ending of the year and now deployment of new commitments.

There is a mild sigh of relief in the fact that the airline outage seems to be getting repaired. Some of the Aluminum Hat Society of Traders wonder if any of the outage could have been caused by a recent hike in solar activity, which has been strong enough to disrupt the shortwave radio signals across a broad spectrum of the earth, but we will make sure nobody reports seeing any aliens.

…In the meantime, stay safe.

Arthur

Commodities Will Go On A Tear

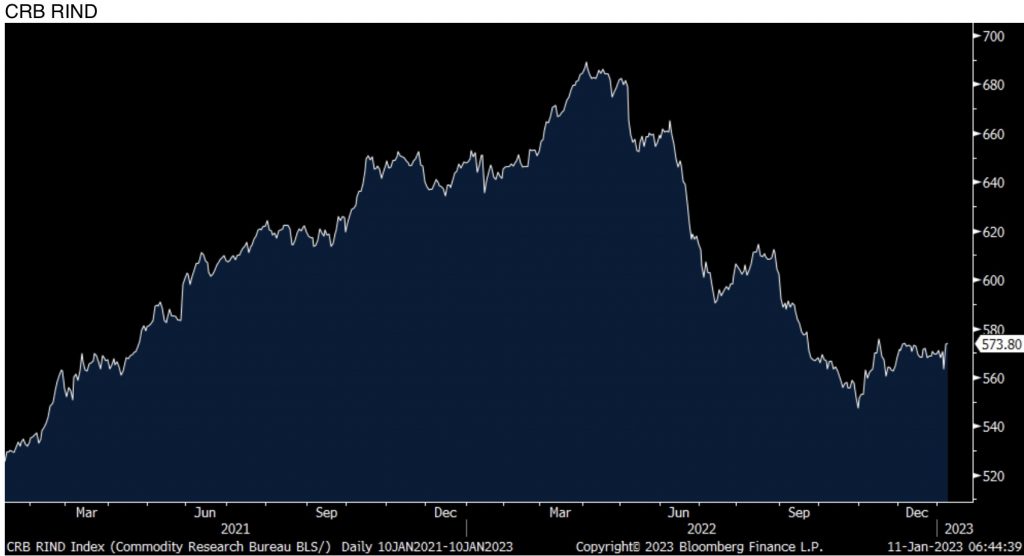

Peter Boockvar: After falling notably since last April, raw industrial prices are on the move higher in response to China’s reopening, as they should. I’m actually surprised how sanguine many are on commodity prices in the face of the 2nd biggest economy finally joining the rest of the economic world in no longer locking down. As of yesterday’s close the CRB raw industrials index is at the highest level in 2 months.

CRB Set To Breakout

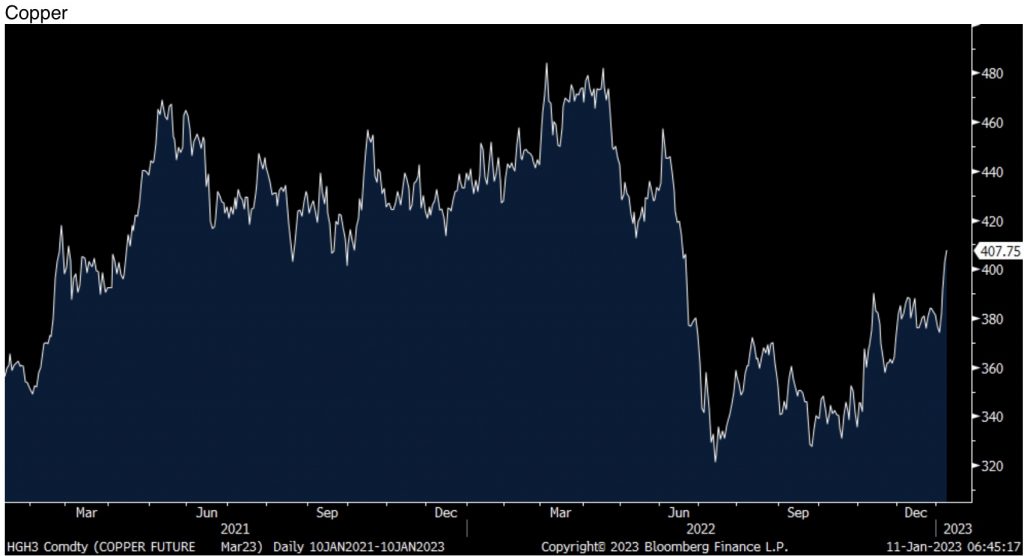

Copper today is quietly rising almost 1% to the highest since June.

Copper On The Move

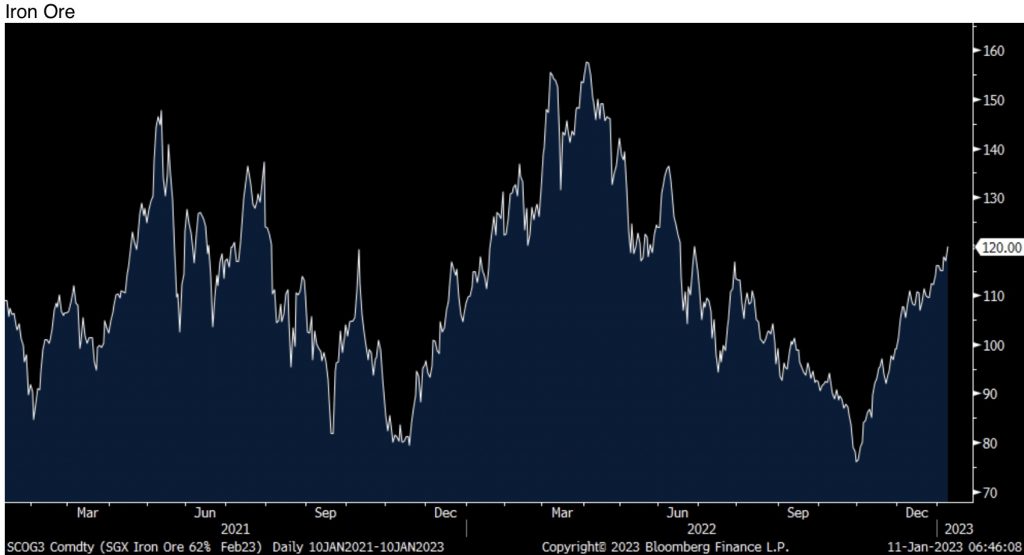

The same for iron ore whose current price was last seen in June.

Iron Ore Prices Have Already Broken Out

Inflation trends are certainly softening overall but I’ll argue again how important the China full reopening is to the global economy and the rise in commodity prices, including oil and gas, we’ll now see after the pullback.

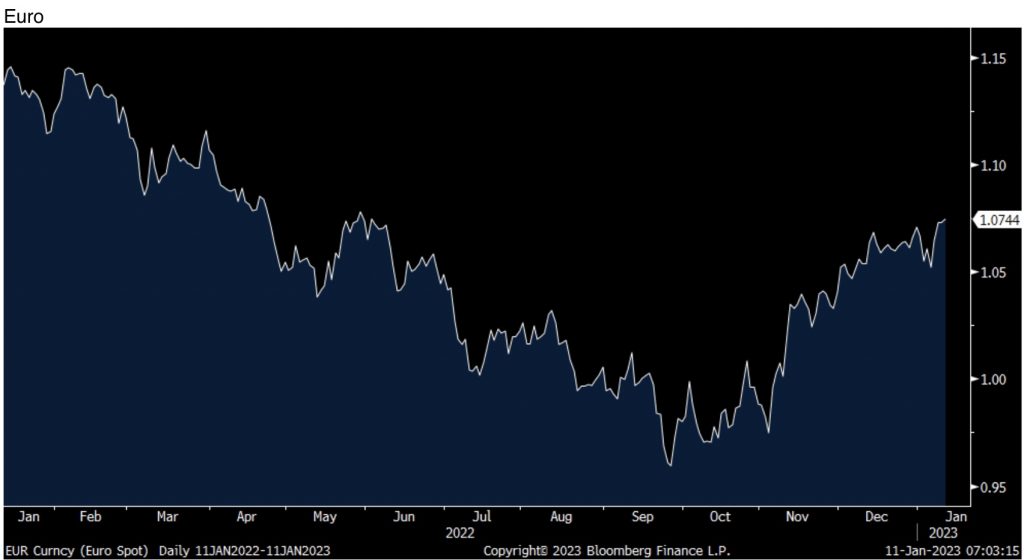

We’re seeing a rally in European bonds that is resulting in lower yields in the US but ECB governing council member Robert Holzmann is telling us today what he’s really focused on. “As long as core inflation isn’t peaking, the change in headline inflation won’t make a change in our determination.” All of a sudden, the euro is at a 7 month high vs the US dollar.

Euro Has Surged Against US Dollar

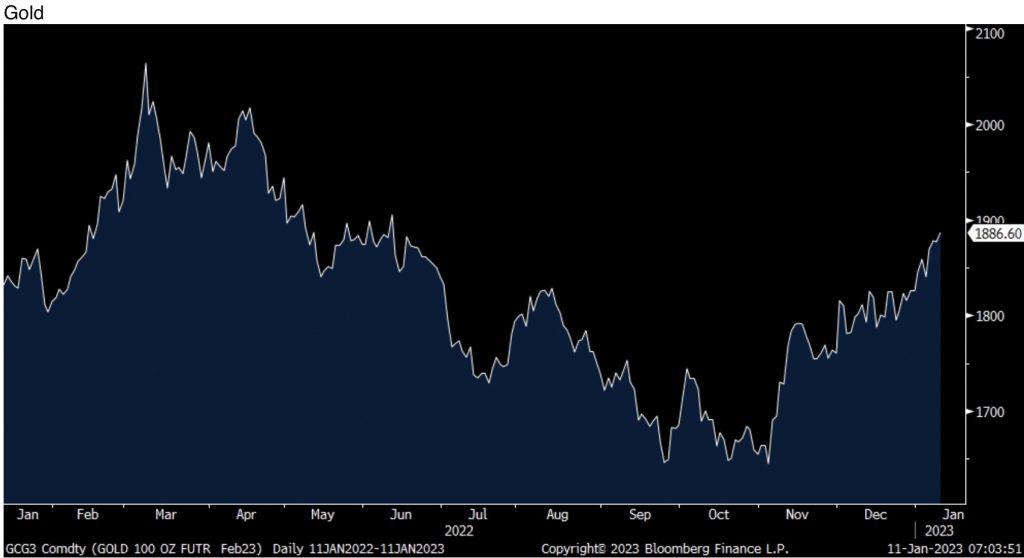

And gold too is at a 7 month high, acting great.

Gold Hits 7 Month High

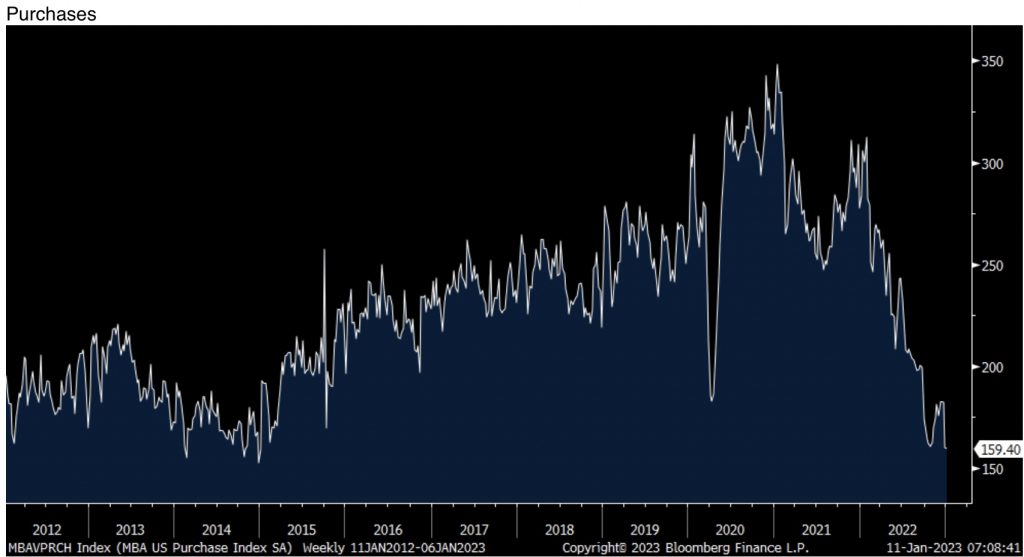

After rising by 16 bps in the week ending Dec 30th, the average 30 yr mortgage rate fell by a like amount in the following week to 6.42%. With very little activity in the last 2 weeks of the year, refi’s rose 5.1% w/o/w but are still down 44% y/o/y. Purchases were lower by .5% w/o/w to the lowest since 2015 and down now 44% y/o/y.

Purchases Hit Lowest Level Since 2015!

ALSO JUST RELEASED: Silver “Rocket Ship” Breakout Is So Close CLICK HERE.

ALSO JUST RELEASED: “Debt Spiral For Borrowers” For Car Buyers, Good News & Bad News For Gold Short Term CLICK HERE.

ALSO JUST RELEASED: James Turk: This Is About To Trigger The Next Major Move For Gold & Silver CLICK HERE.

ALSO JUST RELEASED: SPROTT: Gold And Mining Shares Are Severely Under Owned CLICK HERE.

ALSO JUST RELEASED: Greyerz Just Warned Investors To Prepare For A Hyperinflationary Collapse CLICK HERE.

ALSO JUST RELEASED: Greyerz – The Clear Path For The World Is Now Full-Blown Collapse CLICK HERE.

***To listen to Alasdair Macleod discuss what is happening in Asia as well as what Russia is up to in the gold market along with what surprises to expect as we kickoff 2023 CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.