On the heels of the Iranian attack on US forces and gold soaring above $1,600, Pierre Lassonde and Art Cashin share their thoughts plus a surprise from Jeff Gundlach.

Last night legend Pierre Lassonde sent King World News the following communication regarding the Iranian attack on US forces and the subsequent spike in the price of gold:

“It could all be over in a hurry. Iran has no money to fight a war. Plenty of blisters but old equipment, old planes and not enough bullets. I prefer slow and steady rise to these wild gyrations (in the gold market).” — Pierre Lassonde

The Bond King Projects

January 8 (King World News) – Art Cashin: The Bond King Projects – Late Tuesday, Jeffrey Gundlach, the head of DoubleLine Capital spoke on a webcast. Here’s a bit of what Barron’s reported on the topic:

Jeffrey Gundlach sees a year of more muted returns in 2020 than in 2019, when assets from stocks to bonds to Bitcoin all soared. In a webcast on Tuesday afternoon, the DoubleLine Capital CEO and chief investment officer discussed his outlook for 2020 and beyond.

Despite his forecast for harder-to-find returns, Gundlach doesn’t expect the coming year to be uneventful: “I don’t think it’s going to be the boring ’20s, nor do I think it’s going to be the roaring ’20s,” Gundlach said. “I think it’s going to be a highly volatile period.” He sees the lead-up to the 2020 presidential election as a looming risk for U.S. stocks. Gundlach expects Sen. Bernie Sanders (Ind., Vt.) to win the Democratic Party nomination and President Donald Trump to win the general election, as long as the economy holds up. He worries that should Sanders’ candidacy become stronger, financial markets would sell off in response.

Gundlach noted that the U.S. government budget deficit is at levels relative to gross domestic product that have previously occurred only in times of fiscal stimulus at the depths of previous recessions. If Sanders is elected and implemented, Gundlach sees his progressive platform expanding that deficit to record levels.

“If people get more worried about Bernie Sanders and they start to price in his spending programs, then you could really start to see trouble in both [long-term Treasury] bonds and stocks, which could really be on a rough ride,” he said.

Gundlach sees some risk of a recession in 2020, which he pegs at a 30% to 35% probability. Most likely, however, strength in the job market and consumer spending will outweigh weakness in the U.S. manufacturing sector, he said.

The Federal Reserve and other central banks will be committed to keeping monetary policy accommodative in 2020, as long as they don’t see their preferred measure of inflation moving up, he said. As that happens, he sees longer-term bonds like the 10-year Treasury note falling.

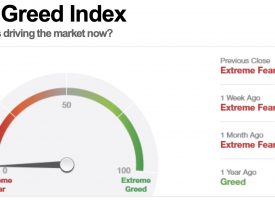

“I think the pattern here should be a steeper yield curve, with the Fed very unlikely to raise rates and with gold going up and inflation expectations starting to show some signs of life and the supply of long-term bonds still bigger than ever,” Gundlach said. “I think organically—without Fed manipulation—interest rates would be rising.”

Gundlach thinks the yield on the U.S. ten year will rise to 2% and that Bitcoin may rally.

Overnight And Overseas – In the initial response to last night’s missile attacks, markets moved rather wildly. Gold soared above $1600 and the Dow futures plunged over 400 points. Then rather quickly, the initial reactions were reversed as markets came to see the Iranian response as limited and somewhat proportional.

Tokyo and Shanghai were caught up in the initial response and closed down the equivalent of over 400 points in the Dow. Hong Kong closed down the equivalent of more than 200 Dow points. India was fractionally lower.

European markets have settled down a bit. London is almost unchanged, while stocks on the continent are trading slightly lower.

Among other assets, Bitcoin continues to rally, now trading around $8300. Gold is firmer, while oil has turned lower. The euro is a shade softer against the dollar and yields are unchanged.

Consensus – Most authorities claim there is no connection between the Iranian missile strikes and the fatal crash of a Ukrainian flight out of Baghdad. The refusal of the Iranians to hand over the flight recorder does inspire cynicism nonetheless.

Stay wary, alert and very, very nimble.

Chaos Overseas

ALSO RELEASED: Gold Spikes $36 To $1,610, Crude Oil Soars 5% On Iranian Attack On US Forces CLICK HERE TO READ.

One of Gerald Celente’s greatest audio interviews ever has been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.

© 2020 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.